Collector of Revenue

Frequently Asked Questions

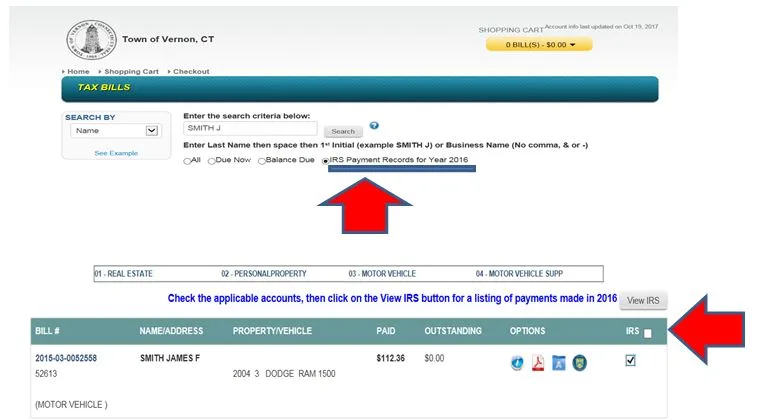

Researching your tax payment records

You can access your tax payment records 24 hours a day, 365 days a year. A search option is available for taxpayers to use when compiling year-end information for federal and state tax filings. This function can also be used to look up tax bills and make payments.

This tax information is public. It is possible that in spite of your best efforts to search, and in spite of our best efforts to provide the information, you may not locate all of the bills you are looking for. If you cannot find what you are looking for by searching one way, we suggest searching another. If you are seeking a definitive answer as to what or how much you owe, speak to one of our tax collector office employee’s. If you are seeking detailed payment history, there is no substitute for the receipt you were issued at the time you made your payment. If transfer of property has taken place, contact your closing attorney with any questions regarding your tax payments.